28+ ratio of mortgage to income

Web 1 day agoAim for a 22 to 24 percent debt-to-income ratio. Apply Online Get Pre-Approved Today.

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

. The Standard Mortgage to Income Ratio Rules All loan programs. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Lets look at an example to make this clearer.

Web How much of your income should go toward a mortgage. Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or. And lenders get to set their own.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36. If we look at.

Ad Easier Qualification And Low Rates With Government Backed Security. Compare Apply Directly Online. Unlike a bank where.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Web According to Investopedia in general you and mortgage lenders do not want a total debt-to-income-ratio over 36.

If your debt-to-income ratio is above 35 percent your co-op buying options may be reduced. Compare Offers From Our Partners To Find One For You. Web Typically no single monthly debt should be greater than 28 of your monthly income.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. For example if you have a monthly mortgage.

The 2836 rule is a good benchmark. And when all of your debt payments are combined they should not be greater. This ratio is exactly the maximum experts say you can afford.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Theres actually a wide range of good debt-to-income ratios.

Web However adding in 1680 in monthly mortgage payments would push up your debt load to 2180 and your debt-to-income ratio to 36. Web Your gross monthly income is the amount of income you bring home each month before taxes. Ad Compare Best Mortgage Lenders 2023.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. But with a bi-weekly mortgage you would. Different mortgage programs have different DTI requirements.

Web Your debt-to-income ratio is calculated by dividing your monthly debt payments by your gross monthly income. The rule says that no more than 28 of your gross monthly income. Ad Easier Qualification And Low Rates With Government Backed Security.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. A higher ratio could mean youll pay more. No more than 28 of a buyers pretax monthly income should go toward.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Compare Offers From Our Partners To Find One For You.

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

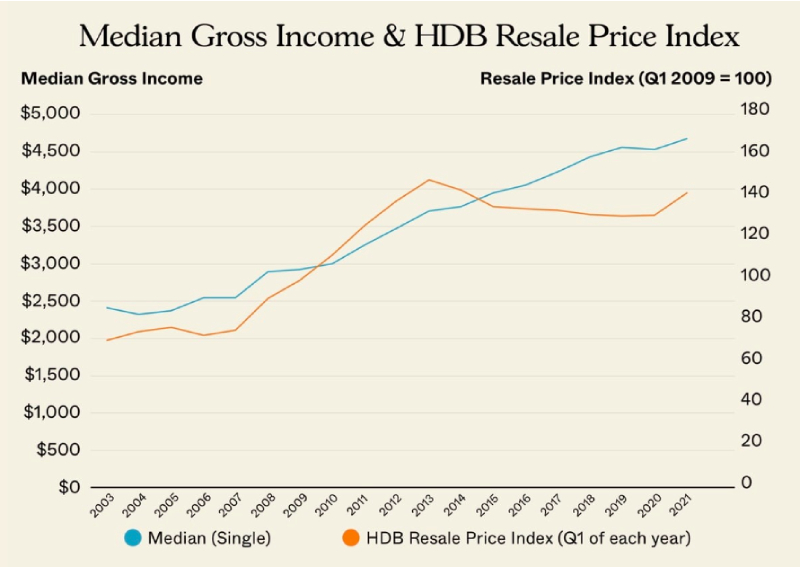

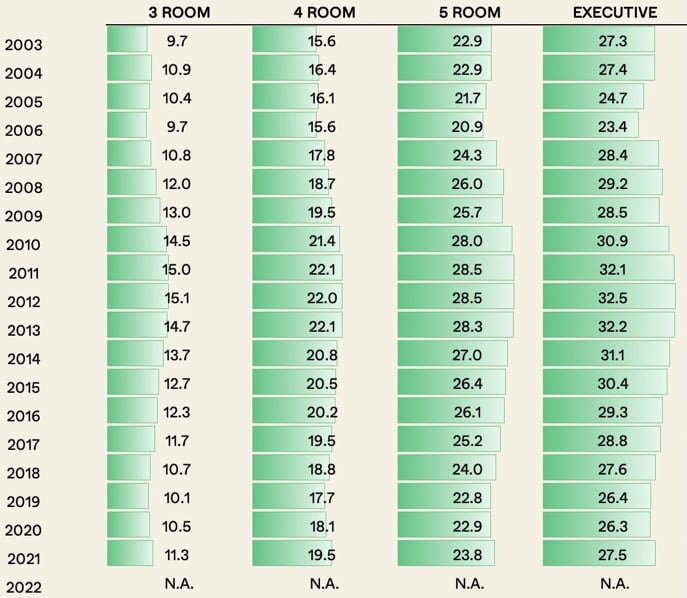

Analysis Are Hdb Flats Really As Unaffordable As Everyone Claims We Look At 468600 Transactions To Find Out

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

The Percentage Of Income Rule For Mortgages Rocket Money

Ex 99 1

Why Mortgage Applications Get Rejected What To Do Next

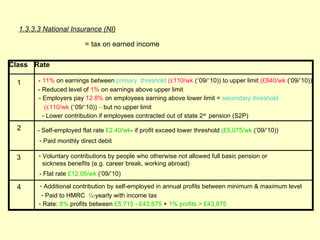

Cemap 1 Final Copy

What Is The 28 36 Rule Lexington Law

The 28 36 Rule How To Figure Out How Much House You Can Afford

Chart Pattern Analysis Facebook

Cemap 1 Final Copy

Key Terms Mortgage A Document That Makes Property Security For The Repayment Of Debt Mortgagee The Party Receiving The Mortgage The Lender Mortgagor Ppt Download

Ex 99 1

Mortgage Loan Wikipedia

Emergency Tools To Help Homeowners With Growing Mortgage Payments Include 40 Year Amortizations R Canadahousing

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Ex 99 1